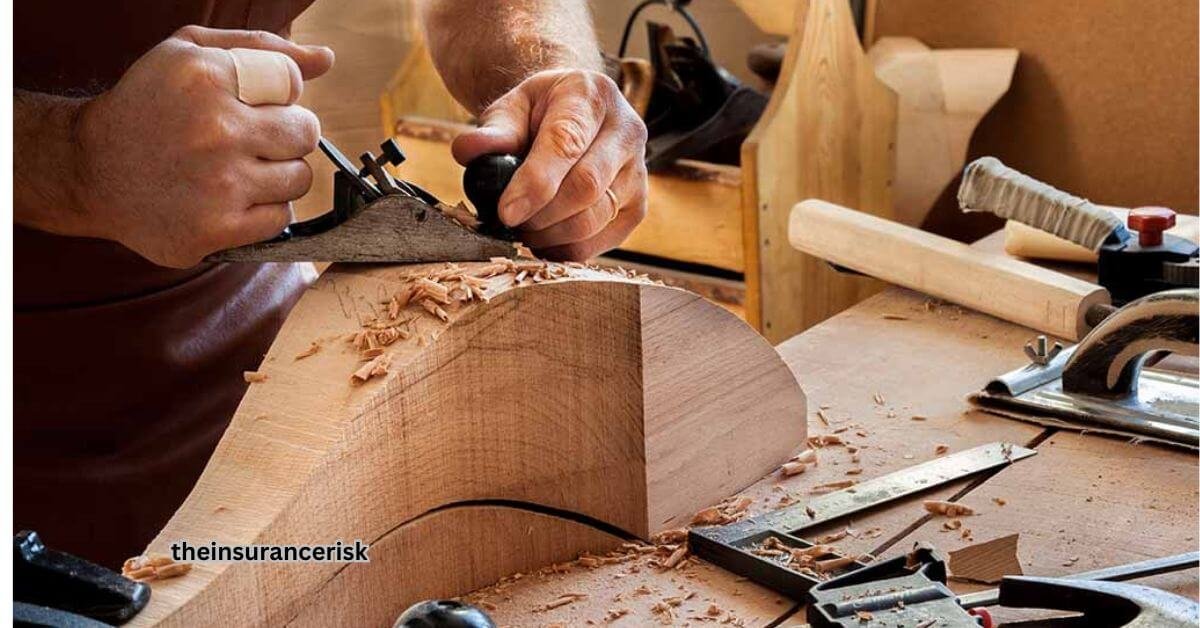

Carpenter Insurance for Secure Coverage and Peace of Mind

Woodworking and construction come with natural risks. Tools, heavy machinery, and challenging work environments make injuries and accidents common. That’s why many carpenters opt for carpenter liability insurance. Insurance is a crucial component of a strategy that can help carpenters maintain the financial health of their businesses. While practicing safety and using common sense on the job is essential, accidents or injuries can happen unexpectedly. To reduce significant losses, having a complete insurance package provides essential protection for your carpentry business.

Carpenter Insurance

Carpenter insurance is a protective coverage that helps carpenters manage and mitigate various risks and unexpected events in their business operations. The carpenter insurance provides essential coverage for carpenters, safeguarding against potential risks and unforeseen incidents.

Carpenter’s insurance is there to safeguard your business when accidents, injuries, or work-related illnesses happen. Policies such as workers’ compensation provide coverage if an employee is injured on the job, and commercial auto policies protect you in case one of your company trucks is involved in an accident with another vehicle or structure. Carpenters have various insurance options, but a basic business owner’s policy covers property damage and liability. For instance, if you accidentally break a window at a customer’s home, property damage coverage helps with repair costs. If someone gets injured on the job, liability coverage assists with legal defense expenses if you face a lawsuit for the accident.

Does a carpenter need insurance?

Carpentry comes with its fair share of risks. Accidents can happen during projects, and a significant claim against your business could have a severe financial impact, putting your livelihood at risk. Carpenter’s insurance is a cost-effective solution to safeguard against these potential challenges.

Imagine you are securing a stud on the second floor of a new home. Suddenly, the board slips, hitting an employee from another specialty contractor below. Although the injuries may be minor, that worker requires medical treatment. A general liability insurance policy can assist in covering the costs of those medical services. With the right insurance for subcontractors, you might be able to secure jobs with a general contractor (GC) or owner. Those who hire you want assurance that both you and they are safeguarded in case anything goes wrong on the job.

What insurance does a carpenter need?

A carpenter’s business owner policy is like a basic package, but it’s smart to check out other insurance options that could help your business. Here’s a list of policies that might be useful for carpenters to consider:

Commercial auto insurance:

If you use trucks or vans, commercial auto coverage comes in handy if you have an accident with another vehicle or damage something like a fence while on a job.

Inland marine insurance:

This coverage keeps your tools, equipment, or building materials protected. It works whether they’re at the job site, at your business place, or in transit.

General liability insurance:

This type of insurance safeguards contractors when someone says their work caused injury or property damage. If you cause an accident or injury on a project, an owner or GC might require you to have this. While it’s only sometimes legally necessary, some states may demand it for licensing.

Professional liability insurance:

If you provide design or consulting services involving the sale of drawings or blueprints, you might need this coverage.

Workers’ compensation insurance:

If you have employees, a workers’ compensation policy helps them replace lost income and pays for medical treatment if they are injured or fall ill due to job-related conditions.

How do I obtain carpenter’s insurance?

In most cases, getting carpenter’s insurance is straightforward. You will need to share basic details about your business, such as payroll information, annual revenue, and any history of previous insurance claims.

To get carpenter’s insurance, simply reach out to an agent or broker. A licensed insurance professional will assist you in figuring out the right insurance policies for your business needs and recommend options to fill any coverage gaps they identify.

After you provide the required documents to your insurance agent, an underwriter will review them along with your application. If your policy gets approved, you might need to make a down payment to finalize the contract. Once done, you will be covered starting from the effective date.

Carpenter’s Insurance Cost

Factors Affecting the Cost of Carpenter’s Insurance The cost of carpenter’s insurance varies based on many factors. Some of these factors include:

Factors Influencing Carpenter’s Insurance Cost

The extent of coverage you choose plays a role in determining the cost of carpenter’s insurance. Make sure to pick policies that match your specific needs.

Your annual revenue is another factor affecting insurance costs. Your rates may be greater than those of a business with $500,000 in revenue if you operate a larger organization with $2 million in annual revenue.

The location where you work matters. If you operate in an area prone to weather events like hurricanes or flooding, these risks might influence your premium. Insurance companies consider historical data to assess the likelihood of claims, and your costs may be determined based on this information.

The nature of their work influences the cost of insurance for carpenters. Carpenters need to specify the scope of their operations. For instance, operating a shop dedicated to creating custom woodwork is different from being a carpenter or framer who also performs other tasks. The type of work you do can impact your insurance expenses.

As a carpenter, it’s crucial to outline all the tasks you perform in your job description. This ensures that the insurance carrier accurately assesses your policy and guarantees coverage in case of a claim.

What other insurance plans can be combined with subcontractor insurance?

A frequently bundled insurance package for carpenters is the business owner’s plan. This includes general liability insurance and coverage for property damage to business assets. You can typically customize this basic package to increase coverage for valuable equipment or add features like basic cyber insurance. But workers’ compensation and commercial auto must have different coverage. Obtaining carpenter’s insurance does not have to be difficult, and the protection it offers you and the other parties involved is peace of mind. It can also make it easier to secure work by providing valid proof of insurance to owners or general contractors.

Secure your insurance coverage.

Carpenter’s insurance builds a strong financial base for your business. It safeguards against costs linked to accidents or injuries on the job, preventing potential financial setbacks. Different policies cover various aspects of your operation, and setting up a comprehensive insurance plan is simple with the help of an insurance agent or broker.